When it comes to managing your Personal Finance effectively, personal finance goals are examples. Setting personal financial goals is essential. By having clear and specific goals in mind, you can stay focused and motivated to achieve financial success. In this guide, we will provide you with examples of personal finance goals to help you get started on your financial journey. Some examples of personal finance goals are:

- Savings Goal: Save 20% of your income every month.

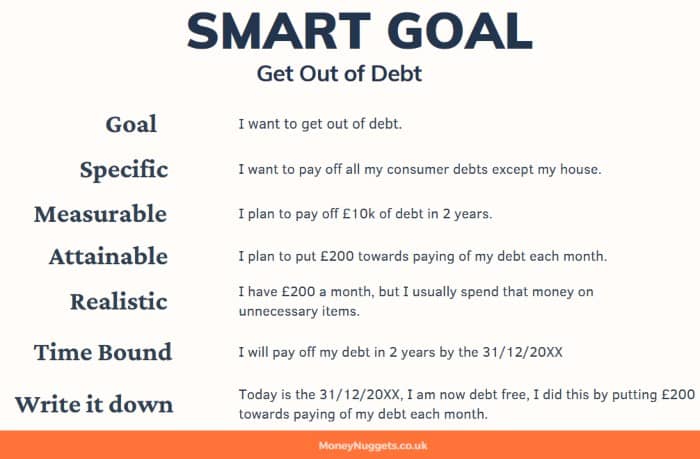

- Debt Payoff: Pay off all credit card debt within 2 years.

- Emergency Fund: Accumulate an emergency fund equal to 6 months of daily expenses.

- Retirement Preparation: Investing a certain amount every month for retirement.

- Cost of Education: Establishing a dedicated fund for children’s education.

- Buying a home: saving money for a down payment on your home within 5 years.

- Buying a car: saving money to buy a new car within 3 years.

- Budgeting: Create and follow a monthly budget.

- Insuring: Taking a suitable insurance policy for life and health.

- Investing: investing a portion of your savings in various investment opportunities, such as the stock market, mutual funds, or real estate.

These goals may vary depending on your financial situation, needs, and long-term plans.

- Monitoring Daily Expenses: Detailing daily expenses and reducing unnecessary expenses.

- Controlling luxuries: reducing spending on unnecessary luxuries such as expensive clothes, shoes, and other unnecessary items.

- Education Loan Repayment: Dissolving your education loan within a specified period.

- Insurance Coverage: Get complete health and life insurance coverage for your family.

- Local Debt Relief: Pay off loans taken from friends or family quickly.

- Donation: allocating a portion of your income to charity or helping the needy.

- Improving Credit Score: Improving your credit score by making loan and bill payments on time.

- Saving for a specific purpose, like a wedding, vacation, or big project,

- Improving Spending Habits: Improving spending habits through budget planning.

- Get financial education: Learn more about financial planning, investing, and saving.

These goals not only strengthen your financial position but also help you avoid financial difficulties in the future. Everyone’s financial situation and goals may be different, so set your own financial goals according to your needs and circumstances and try to stick to them.

- Setting up a retirement account: opening an account for retirement as early as possible and depositing money into it regularly.

- Tax Planning: Managing your tax payments effectively to take advantage of tax-saving opportunities.

- Budgeting for household expenses: creating a specific budget for household expenses such as food, bills, and other necessities.

- Counseling for Financial Objectives: Consult financial advisors for better financial planning.

- Self-investment: investing in your skills and education to increase future income opportunities.

- Donating: Donating regularly for community or social services.

- Saving for vacations: Save a certain amount of money for vacations every year so that you can travel without financial stress.

- Organization of Financial Records: Keep all your financial documents, bills, receipts, and bank statements organized and safe.

- Financial Independence Goal: To achieve complete financial independence within a specified period and be free from debt and financial difficulties.

- Additional sources of income: finding sources of additional income such as freelancing, part-time jobs, or starting a small business.

These goals not only provide you with financial security but also financial stability and peace of mind at different stages of life. Achieving these goals requires consistency, planning, and financial discipline. Set goals according to your priorities and follow them step by step to achieve financial success.